Explore the latest developments concerning My favorite stock.

My favorite stock to buy right now — and yes, of course it's Nvidia stock (NVDA)

The Motley Fool offers a range of services designed to help you achieve your financial goals. Click here to learn more about our membership options.

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

The company has orders worth way more than its annual revenue.

Citi Raises Nvidia Price Target to $720 Ahead of Earnings

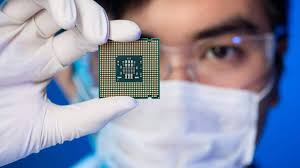

Nvidia (NVDA, Financials) just got another confidence boost from Wall Street. Ahead of its upcoming earnings report, Citi Research raised its price target on the AI chip leader to $720 from $650, saying demand for Nvidia's processors remains as strong as ever.

Citi's analysts called Nvidia the undisputed leader in artificial intelligence computing a title it has earned thanks to relentless demand for its H100 chips and growing excitement over its next-generation Blackwell GPUs. Those products are expected to power data centers well into 2026 as companies race to expand their AI infrastructure.

While some investors worry about chip supply constraints and pricing fluctuations, Citi said Nvidia's long-term advantage lies in its deep ties with cloud giants, software ecosystem, and unmatched developer tools a combination that keeps competitors at bay.

Sports Watches Smartwatch Bluetooth Call Touch Dial for Android iPhone Music Fitness Tracker Sports Watches

The dynamic landscape of current events often brings forth significant discussions. Monitoring these developments provides crucial insights.

For more detailed information, explore updates concerning My favorite stock.